Life in paradise awaits… if only you could secure Costa Rica real estate financing? In that case, your dream may be closer than you expect!

You’ve probably been googling about, researching your options. And you may be a little surprised at what you’ve found: some sources claim financing is nearly impossible, while others state that there are lots of options. In reality, the truth leans more toward the latter, with a few provisos. (In fairness, the former was accurate 10+ years ago.)

Here’s the truth (current for early 2022): Home financing in Costa Rica is very possible. But, it’s probably not as easy or as straightforward as you’re used to. That’s due not only to Costa Rica’s propensity for paperwork (we almost act as if we love it, even though no one really does) but also because you haven’t established the same kind of financial history here as you have back home.

In other words, you may have a history (and present) of gainful employment, proof of income, and a great credit score in your home country, but Costa Rican banking institutions probably don’t have the same kind of access to those records. That said, you won’t be starting from scratch, either, and you can very likely secure Costa Rica real estate financing. Here are the most popular options for residents and non-residents, alike:

Costa Rica Real Estate Financing by Owner (aka Seller Financing)

Owner or seller financing is one of the most flexible types of Costa Rica real estate financing, not only regarding terms but also documentation. You’ll find that, as people vary, so do the people (and their preferences) behind owner financing.

Some sellers will request proof of income while others won’t; some will offer shorter terms (ex. 1-3 years) and others are willing to go longer (up to 10 years); some request a fixed amount down (say, $100k), while others request a percentage (usually 25-50%) of the negotiated selling price; some will request monthly payments and others will prefer semester or annual contributions; some will offer interest-only loans, while others will dive into principal + interest loans. Etcetera, etcetera, you get our point!

Like a home’s selling price, seller financing is negotiable, to a certain extent. Of course, many sellers do not provide any financing at all. So, while owner financing has long been one of the “easiest” – and all things are relative, of course! – ways to secure Costa Rica real estate financing, it’s often not an option.

Home Equity Loans

Have you banked home equity? Then ocean views in Costa Rica could be yours!

Home equity loans, also known as second mortgages, can be a great option for financing a property in Costa Rica.

One of the great benefits to home equity loans is that you’ll take out a home equity loan in your home country, not Costa Rica, which means you’ll have easy access to proof of income, your credit score, and other indicators that traditionally help you secure a loan.

The potential hiccup, of course, is equity: To take out a home equity loan for a second home, you must have equity in your first home. For example, if you purchased your home for $500,000 with 20% down ($100,000) and have already paid off $175,000 in mortgage principle, while your home’s value has increased to $600,000, then you’d have about $375,000 in equity ($100,000 down + $175,000 paid principal + $100,000 appreciation).

Typically, buyers in Costa Rica leverage a home equity loan + down payment savings to pay in full, as cash buyers, for their Costa Rican property. As a bonus, it’s fairly quick and easy, your loan transactions are conducted in English, and your loan isn’t contingent on the home you’re purchasing in Costa Rica, so there are fewer headaches. And finally, Costa Rica will see you as a cash buyer – a point solidly in your favor!

Self-Directed IRAs

Many U.S. citizens are unaware that they can direct their IRA retirement funds to purchase an investment property in Costa Rica.

The short of it is that, as you know, you can direct how to invest your retirement funds. Most people choose a mix of stocks and/or mutual funds, but an IRA also allows for diversification into real estate investing, as long as the underlying asset is a tangible piece of property. (Check!)

There are limitations to this investment, most importantly that it is used for investment purposes only. That means that, while you may rent your property as a vacation home or long-term rental (and accrue income and appreciation along the way), you may not vacation in the home. Therefore, most buyers use this payment method to purchase tomorrow’s retirement home, rather than today’s vacation home.

Bank Financing

Bank financing in Costa Rica has not always been a picnic. Traditionally, it was difficult for non-citizens to even have a chance at a loan and, when they did, the requirements were onerous, the paperwork and its necessary translations a huge headache, and the interest rates sky-high.

We’re happy to say, your bank financing options have improved. But, fair warning: the process is probably nothing like what you’re used to. In theory, Costa Rica real estate financing is available to anyone; in practice, they’re still a challenge to secure, even if you’re a resident or citizen.

If you are granted bank financing, you will likely secure a 15-, 20-, or 30-year loan that requires a sizeable down payment, usually in the range of 35-50%. What’s more, interest will likely be higher than what you’re used to – usually 7-10% interest for U.S. dollar loans. (Costa Rican colones loans have higher interest, up to 20%!) And of course, you’ll have plenty of paperwork to sign.

That said, the entire process is easier than you’ve read about (especially in older articles and posts) because the processes have become more streamlined in the last few years. If you don’t have access to owner financing or a home equity loan, or if you simply prefer local bank financing, then it is very doable.

Which brings us to…

New! BCT Costa Rica Real Estate Financing Option for U.S. Citizens

Banco BCT S.A., a Costa Rican bank, has just announced a new financing option for U.S. citizen residents and non-residents of Costa Rica.

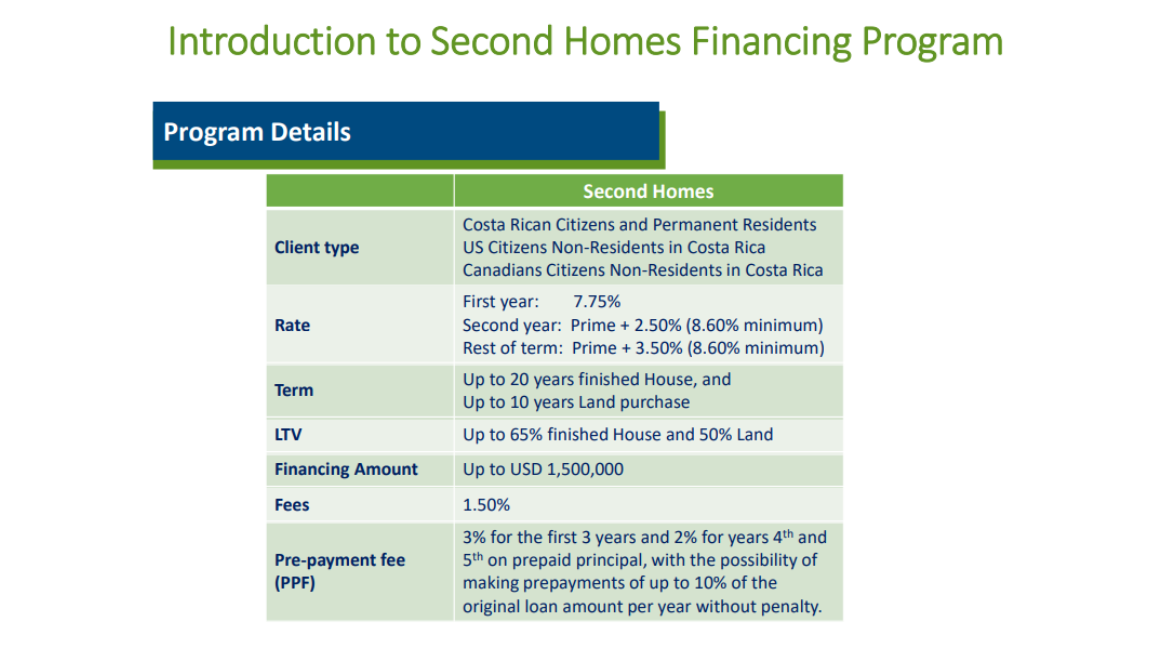

BCT now offers second home loans and bridge loans, with a loan-to-value (LTV) of up to 65%. In other words, BCT will finance up to 65% of a home’s value, for an amount up to $1,500,000 (approximately 65% of a $1.35M home). Terms up to 20 years are available, with fixed and variable rates around 7.75% to PR+2.50%. Loan details are available in English.

The requirements are fairly straight-forward and include your U.S. credit score, two years of tax returns, 12 months of financial statements, and similar requirements.

Planning on a Move to Paradise?

So many Costa Rica real estate financing options, so little time? Moving to Costa Rica can take years to plan, even if it only takes a few days to make the leap. We’ll be here for all of it – from those first tentative feelers (could I really do this?) to unpacking your bags, we’ll help you be as nitty-gritty-planner or as footloose-and-fancy-free as your heart desires.

Really. Whether you’re just getting your toes wet in the dreaming stage or have already made the move, we are happy to answer questions. We’re happy to make connections. And we’re even happier when we make new friends.

Along the way, we’ll help you explore all the many possibilities, joys, and roads to life in paradise. That’s what we do. Because at Blue Water Properties, we thrive on relationships. We crave connection. And our goal is never to “sell a house;” it’s to fulfill dreams. It’s to make people happy. It’s to help you. Genuinely help.

We promise the fastest communication and best services in the industry. We will work to deliver on your dream. We will never pressure you. And we really do hope we’ll become friends along the way.

We’re proud to offer some of the best Costa Rica real estate, from condos and homes to land and businesses for sale. So, go ahead – try us. Give us a chance to show off our expertise – and wow you with the possibilities! We look forward to it.